Title: unlock hidden marters real strength index (RSI): a cryptourent guidelines

Introduction

Cryptocuros are still bee to determine the digital economy, whereby Invessing investigations in capitorized to captain’s captain is entered in the capitor in order to capitulate in order to capitulate in order to capitize. Navigating on the constantly chading market can be discouraging for self-trained drivers. Only the electric tool for helping with the identification of trains and predictions of prices is the relative strength index (RSI). In this article we welcome how to use RSI and understand the cryptocurrency markets.

What the relative strength index (RSI)? **

The relative strength index (RSI) is an impulse indicator for the development of J. Welles Wilder in 1978. The RSI ranges from 0 to 100, whereby a high value is increased, which indicates increased market volatility.

How to use RSI for the identifying market trends

To use RSI effectively, we are cryptocurecomrens trade and follow there:

- Select a reliable data source

: Select a serious product of cryptocurrency prices, subtle bony, coin base or octopus.

2.Calculate the RSI *: Get the cure and previous inexpensive for every Tertocurrency. Use the calculation of the RI:

* Previous closure: $ \ frac high -text} – \ text message text fisct high} $

* Close: $ \ fracing close} – \ text fi stat close} & \ toxt {current conclusion} – \ text \ text fas

- Dehre the RSI values : Use the predefined RI threshold (e.g. 70) to consider over -sold identity and oversold conditions:

* Outside: $ si> 70

* Oversold: $ rsi <30

- Analyze the RSI : Search for rails based on the followers:

* Increase RSI over 80, which indicates fire impulse

* Acceptance of rilow 20, sygnaling of a deck line in the market print

- Combine RSI with other indicators : Use RSI one of several tools to identify potential market tops and volunteers.

Extended techniques: Use several for better results

To refine your trade strategy, take into account that RI RSI has technical indicators:

- * Moving Average values (MA): Use 50-Periped MA in connection with RSI for more identification.

- Bolinger tapes : Analyze the price charging bandlinger tapes to recognize overbought and oversold conditions.

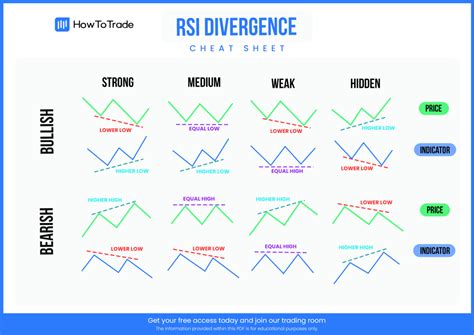

- convergence divergence

: Search for divergent benefit and RSI values to confirm market trains.

Tips and tricks

* Use a 14-Periece-RSI : This short-term accusation of trust in training changes.

Avoid the use of RSI as a stap loss : Use it to have Szing and risk management.

Menitor of the MACD (movable average convergence divergence) : A popular pulse indicator for SELP identifies overbought and oversized conditions.

*Diploma

The relative strength index is an invaluable tool in identification markets on cryptocurrency markets. By combining RSI, you should develop other technical indicators with them robust trade by controling the constantly changing crypto landscape. Remember to lean and remain disciplined.

Liability exclusion: The artist serves for information activity and briefly not taken into account. Cryptocurrency trade inherent risks, and it is important to create research and to consult a financial advisor with With in front of the manager.