Here is a comprehensive article on the risk management of the exchange rate in the crypt trade:

Managing the risk of replacing the crypt in trade

The world of cryptocurrencies has experienced rapid growth and acceptance in recent years. However, this growth has a significant challenge: the risk of exchange rate. As cryptocurrencies, such as bitcoin and Ethereum, have become increasingly popular, with their prices fluctuating wildly on market emotions, regulatory changes and other factors. The risk of exchange rates can be detrimental to cryptoms for traders as this can cause significant losses if properly controlled.

Understand the risk of exchange rate

The risk of exchange rate on one stock market is the price of cryptocurrencies and the other on the other stock exchange on another stock exchange. For example, if you buy Bitcoin (BTC) for Coinbase for $ 10,000 and sell it to Binance for $ 15,000, your profit will be $ 5,000, but your loss would be $ 5,000 if you returned US dollars back to BTC. This illustrates how the exchange rate can occur in trade with cryptoms.

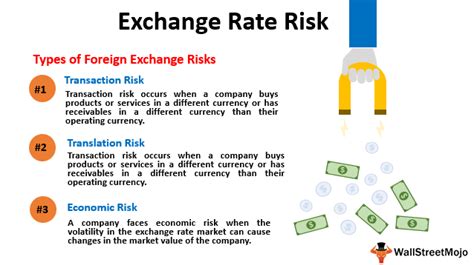

Types of exchange rate -risk

The exchange rate risk has two main types:

1.

- Risk of goods : This type of exchange rate is affected by raw material prices such as gold or oil.

Manage the exchange rate risk

Manage the risk of cryptic trade exchange rate:

- Diversification : Share your investments on various cryptocurrencies and stock exchanges to minimize exposure to the market.

- Safety : Use financial instruments such as futures contracts, options or replacements to protect yourself from pricing fluctuations.

- Size of positions : Determine the risk of trade risk to avoid significant losses when the market moves against you.

- STOP orders : Set commands to lose the stop to automatically sell their position when it reaches a certain price to limit potential losses.

- Explore prices

: monitor the price of the cryptocurrency and stay up to date with newspapers and trends to make good business decisions.

Proven procedures to manage the risk exchange rate in the crypt trade

1.

- Understand stock exchange fees : Be aware of commissions or fees on various stock market stores.

- Monitor cryptocurrency prices : Beware of market emotions and trends to make well -founded business decisions.

4.

Conclusion

The risk management of the exchange rate in the crypt trade is decisive for investors who want to avoid significant losses due to the fluctuations of prices. By diversifying investments, risks and determining the positions of appropriate orders and keeping orders can minimize market volatility and make good business decisions. Always be aware of the prices and trends of cryptocurrencies to optimize business strategy.

Hope this article helps!