“The Rise and Fall of DOGE: How Supply and Demand Shaped the Cryptocurrency Market Cap”

In the world of cryptocurrencies, few assets have captured the imagination of investors and enthusiasts like Dogecoin (DOGE). Created in 2013 by Billy Markus and Jackson Palmer, DOGE initially gained popularity among gamers and collectors before eventually becoming a mainstream success. In this article, we will take a closer look at the crucial role that supply and demand played in shaping Dogecoin’s market cap.

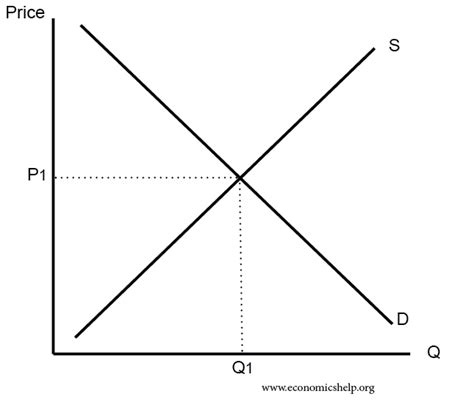

Supply and Demand

Essentially, the cryptocurrency is based on a decentralized network where miners compete to solve complex mathematical problems in exchange for newly minted coins. The amount of money circulating in the market is determined by two main factors: supply and demand.

Supply refers to the total number of DOGE tokens created, which does not exceed 1 billion. While the pace of new coin creation has slowed over time due to increasing competition and regulatory scrutiny, the total supply remains constant.

On the other hand,

demand

for DOGE has fluctuated wildly throughout its history. In the early days of the meme-based cryptocurrency, DOGE’s price rose rapidly due to a number of factors, including:

- Initial hype: DOGE was one of the first cryptocurrencies to attract a lot of attention, and many investors are eager to get in on the action.

- Meme culture: The emergence of social media platforms like Twitter and Reddit has allowed Dogecoin users to share their love for the currency, creating a sense of community and increasing demand.

- Consideration: As DOGE’s popularity grew, so did its rarity. The limited supply of tokens created a sense of urgency among investors and caused prices to rise.

However, over time, DOGE’s price started to fall due to various factors such as:

- Regulatory Scrutiny: In 2017, the U.S. Securities and Exchange Commission (SEC) issued an alert on DOGE, calling it a “security” and urging investors to register their investments.

- Market Fluctuations: The cryptocurrency market is known for its volatility, which has increased selling pressure on DOGE.

Price Action

Dogecoin’s price action has been shaped by the interplay of supply and demand. Here’s a quick look at the key price changes:

- 2013–2017: DOGE grew rapidly due to its initial publicity and meme culture.

- 2018–2020: The price dropped significantly due to regulatory scrutiny and market fluctuations.

2021 so far*: Despite continued volatility, DOGE price has shown some signs of stabilization.

Conclusion

The rise and fall of Dogecoin is a reminder that cryptocurrencies fundamentally depend on the dynamics of supply and demand. While the initial hype around DOGE led to an environment of sharply rising prices, regulatory controls and market volatility ultimately led to its demise. Understanding these factors can help you as an investor make more informed decisions about investing in cryptocurrencies like DOGE.

In summary, the history of Dogecoin is complex and highlights the complex relationships between supply and demand in the cryptocurrency market. By examining historical price movements and market conditions, we can gain valuable insights into the factors that influence the prices of these assets.